News

Insights

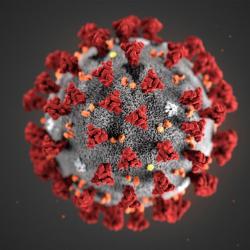

Large Employers, Health Care Providers, and Federal Government Contractors - What Do the Federal COVID-19 Mandates Mean to You?

November 24, 2021

As we have reported since the COVID-19 pandemic began, it has created numerous and unprecedented requirements for employers to navigate. Now, pursuant to OSHA’s COVID-19 Vaccination and Testing Emergency Temporary Standard (“ETS”), President Biden’s Executive Order 14042 for federal go... Read more >